nebraska lottery tax calculator

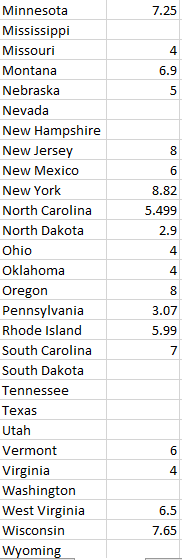

The Tax Foundation is the nations leading independent tax policy nonprofit. All winners of prizes in excess of 5000 are subject to a federal tax while several of the participating states are also subject to their own tax.

Lottery Tax Calculator Updated 2022 Lottery N Go

These lottery tools are here to help you make better decisions.

. You can find out how much tax you may pay below. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. To use the calculator select your filing status and state.

152 million a year or 264045 million cash in one lump sum New Hampshire. You need to select the residing State to set the tax percentage. Heres how much taxes you will owe if you win the current Mega Millions jackpot.

231 Million Jackpot Annuity Audit. Our calculator has recently been updated to include both the latest Federal Tax. You can see the reflected amounts for the jackpot annuities down below.

Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. Lottery prizes are usually calculated using a fixed percentage of ticket sales. You must also pay any remaining federal taxes state taxes rate varies per state plus applicable local taxes.

69 Nebraska state tax on lottery winnings in the USA. Our network attorneys have an average customer rating of 48 out of 5 stars. Are lottery winnings taxed twice.

Lottery winnings are taxed at both the federal and state levels. Without Federal Tax Deduction it would be tough for lotteries to pay winners with mega millions and Powerball. Get the right guidance with an attorney by your side.

How to Use the Lottery Tax Calculator. 5 tax but other taxes bring it to 684. With the Social Security calculator you can not only figure out what your benefit will be when you retire but you can also use the information you Aug 16 2022 3 min read Leaving Money for College.

But buying lottery tickets online as part of a Powerball pool allows you to play 35 tickets at a time by splitting the cost with other players. How much tax do you pay on a 10000 lottery ticket. Lottery Annuity Calculator uses federal Tax Deduction to calculate jackpot prize payout on more significant mega millions Powerball and lotto jackpots.

When you choose the State this calculator will do its job automatically. Some places such as New York City also charge a municipal lottery income tax. You can find out tax payments for both annuity and cash lump sum options.

200 Mega Millions Jackpot Winners used this calculator to check their actual winning amount. The calculator will display the taxes owed and the net jackpot what you take home after taxes. So if you really want to be a Powerball winner then this is the cheapest easiest way to achieve your goal.

If winning the lottery is still just a dream then youll know that the odds of your ticket winning certainly arent great. 25 State Tax. For one thing you can use our odds calculator to find the lotteries with the best chances of winning.

5 Nevada state tax on lottery winnings in the USA. Nevada State Tax Calculator. Compare the odds between your favorite lottery games and focus on the ones that show the most potential.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. Forget about complicated tax calculations for your lottery winnings. Lottery Tax Calculator calculates the lump sum annuity payments and taxes on Megamillions Powerball lottery winnings and provides accurate data to a user.

How Our Lottery Calculator Can Help You Play Smarter. Nebraska State Tax Calculator. The lottery tax calculator helps you establish how much of the estimated jackpot amount will be taken by the state and federal tax rates.

In other words it calculates how much cash is owed in federal tax and state taxes as well as how much of your prize money will remain untouched. Georgia Salary Tax Calculator for the Tax Year 202223 You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223. Thanks to our simple tool you only need to enter a couple of variables and check out your tax.

No state tax on lottery prizes. The IRS automatically withholds 24 of that amount. Lottery Number Generator.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Blog For Lottery Beginners And Experts Lotterytexts Com

Megamillions Payout And Tax Calculator Lottery N Go

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator Updated 2022 Lottery N Go

Lottery Tax Calculator Updated 2022 Lottery N Go

Top 5 Best And Worst States To Win The Lottery

Lottery Tax Calculator Updated 2022 Lottery N Go

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax